Yolt promises to make managing your finances intuitive and even– dare we say it? – Fun.

The app was developed by a start-up owned by ING bank Click To TweetThere’s no shortage of platforms and applications out there that promise to help you keep track of your finances, and of course most banks and credit cards now offer their own proprietary apps that let you access your account(s) on the move.

But if you’re anything like me, you will have many different accounts in your household, and keeping track of them all over the course of a month can become a bit of a nightmare. So I don’t exactly tend to look forward to the “time of the month” when I wrestle my finances spreadsheet submission. That time, I’m ashamed to say, usually only comes around when my “to be filed” drawer fills up to the point where I can no longer close it, and the whole wretched process ends up robbing me of a good few hours which I’m sure could have been better spent elsewhere. This, however, is precisely the pain point that a new smart money management platform called Yolt is setting out to solve.

“In modern life, the phrase ‘time is money’ has never felt more apt,” says Frank Jan Risseeuw, Yolt’s CEO. Yet he points out that in this age of instant gratification, few of us have the patience to manage our finances properly. “We need to package that functionality in a way that provides convenience, speed and customization in a very intuitive way,” he explains.

Yolt was founded in 2016 and is owned by leading European bank ING, so has some serious resources behind it. They’ve been testing and improving the app in closed beta since October last year, and have now launched their open beta in the UK, meaning users in the country can now download the app for free on iOS and Android.

“Everyone has their own habits and routines, especially when it comes to saving, spending and budgeting. Over the last 16 months we’ve spoken to people about what matters most to them. We’re inspired by the lives and stories of our users, and want to create solutions based on those real life situations within our app,” adds their Head of Strategy and Marketing Pauline van Brakel.

I took Yolt for a spin and was quite impressed by how straightforward it was. After download and installation, it takes a few seconds to setup a single secure pin that gives you access to the app, and then you proceed to link your various bank and credit card accounts to it so you can view all your transactions in one place.

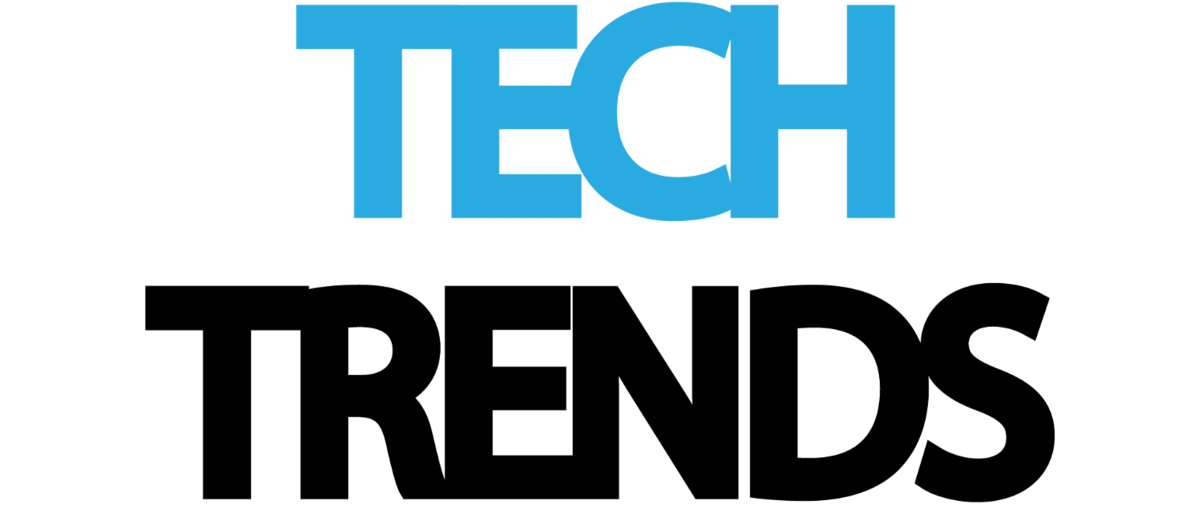

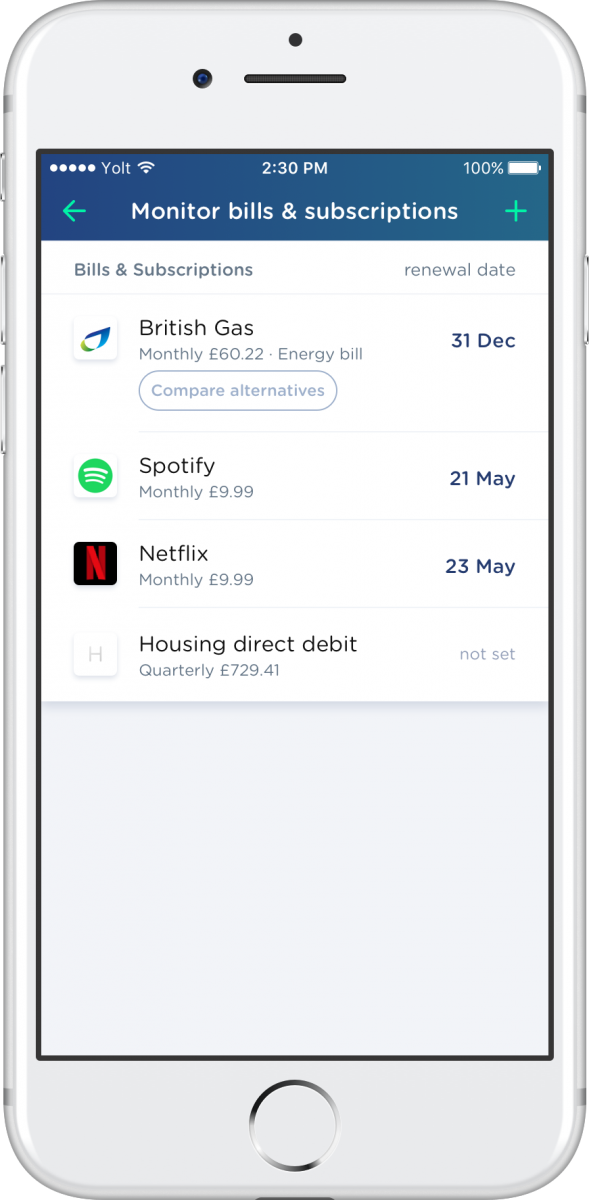

The idea is to allow users to build up a holistic view of their spending patterns, using past transactions to make realistic projections and enable better planning and adjustments.

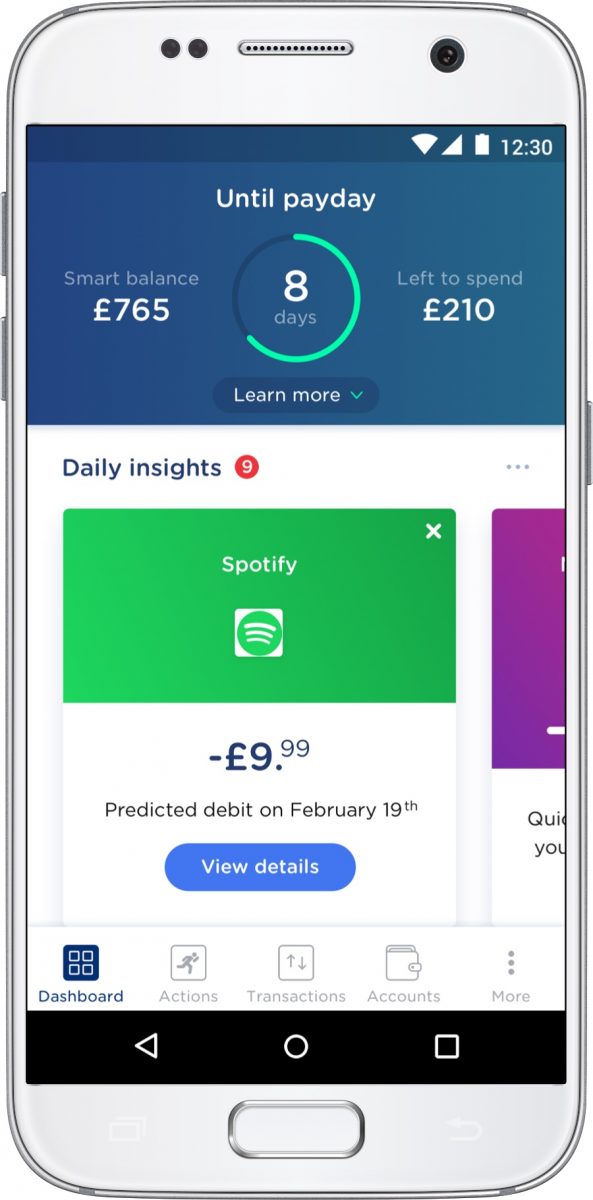

Yolt allows users to build a holistic view of their spending patterns Click To TweetThe most surprising thing I found was actually how I started having a bit of fun with building up my monthly budget. The app pre-suggests categories such as Eating Out, Groceries, Housing, Travel, Cash, Bills, etc. and allocate how much you want/think you should spend on each one. Once you link your various accounts to the app, you can then see how realistic those projections actually look. And that is probably Yolt’s biggest USP.

I tried several budgeting apps in the past, but what I like about Yolt is the way it brings those budgeting functionalities together with the reality of what you finances actually look like. Having real data at your fingertips is very empowering, and makes building a realistic budget a lot easier. There is often a gap between how much we think we spend on things such as eating out or having a takeaway latte every morning, and how much these things actually cost. With this app it can become a little bit easier to start bridging the gap between wishful thinking and reality, and making more responsible choices about our finances.

The next step following the UK open Beta will be for Yolt to partner up with more Fintech companies to add more features to the app, such as price comparison functionality for energy providers, for example.

“We want to challenge the status quo of money management and harness the power of open banking empower people to take back control of their finances and make smarter decisions,” says Jan Risseeuw. That way, he concludes, we can all spend less time worrying about money and more time actually enjoying life.

![]()

For companies looking to gain a competitive edge through technology, Tech Trends offers strategic Virtual Reality and Digital Transformation Consultancy services tailored to your brand.

Alice Bonasio is a VR and Digital Transformation Consultant and Tech Trends’ Editor in Chief. She also regularly writes for Fast Company, Ars Technica, Quartz, Wired and others. Connect with her on LinkedIn and follow @alicebonasio on Twitter.