Non-legitimate refunds cost merchants billions every year, but Fintech company Verifi is using data insights to spare them costly chargebacks.

In a digital economy, the rule of thumb tends to be that the smarter your use of data and technology, the more of a competitive edge your business has. This is particularly true in the e-commerce and retail sectors, where small inefficiencies can quickly compound and become large-scale problems.

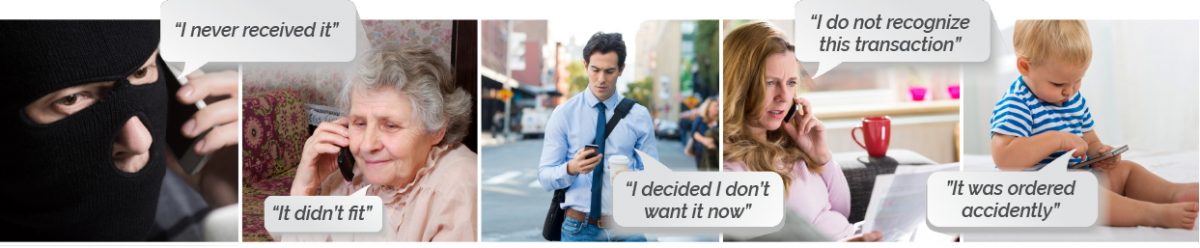

In a digital economy, leveraging contextual data gives businesses an edge Share on XTake, for instance, the deceptively innocuous-sounding problem of “friendly fraud.” The term is used to describe a situation when a customer experiences “buyer’s remorse” and “tries it on” by putting in a claim directly with their bank or card issuer for a refund, when the sale did in fact legitimately occur.

“Since many such claims are relatively low-value, banks will often issue the refund rather than dedicating the resources needed to investigate and dispute each transaction,” explains Matthew Katz, CEO of payment management and resolution platform Verifi. Their research in fact showed that up to 86% of cardholders bypass the merchant and contact their issuing bank directly to dispute or question a charge on their bill. “When you add all of these claims up, it amounts to a huge problem for the industry, with billions of dollars in costs being passed onto merchants, and – ultimately – to the consumer,” he says.

Julie Conroy, Research Director of the Aite Group adds that in the States, in Q1 of 2017 alone, friendly fraud and chargebacks would likely near $130 million, with the global figure in 2016 being closer to $30 billion. There are many reasons why consumers make these claims, yet they’re not all necessarily sinister or even dishonest. In an age of speedy payments, where we can tap our cards or phones at a shop and walk away with our purchases within seconds or order through a mobile app with a single click, we often forget what we bought over the course of a day, nevermind a week or a month. I for one know that over the years I’ve had trouble clearing my bank’s security questions when they required me to name the amount of the last few transactions I had made on a certain card. A guesstimate was all I could ever manage without actually looking up a statement.

Friendly Fraud is a growing problem for retailers and digital merchants Share on XThis is further compounded by the fact that often the registered merchant name that appears on statements can be different from the trading name on their shop front or website – which is why services such as PayPal usually make a point of telling you that “this transaction will appear on your statement as…” But regardless of the reasons behind it, friendly fraud amounts to a serious problem, especially for merchants dealing in digital goods. A report from Javelin Research estimates that the increase in card-not-present (CNP) fraud and chargeback management now consume between 13% and 20% of operational budget for such retailers: “Fraud and chargeback spend is front and centre for digital goods merchants, with these merchants dedicating significant proportion of operational costs to keeping fraud in check.”

Yet even with such resources dedicated to fighting fraud, not having the right information on hand at the right time can mean that those businesses not only leave themselves open to fraud, but they also risk losing customers and reputational goodwill by challenging legitimate customer claims. To avoid such issues, banks and merchants need to be able to share customer and transaction information in near real-time with the issuing bank or consumer, and that’s where platforms such as Verifi provide the missing link.

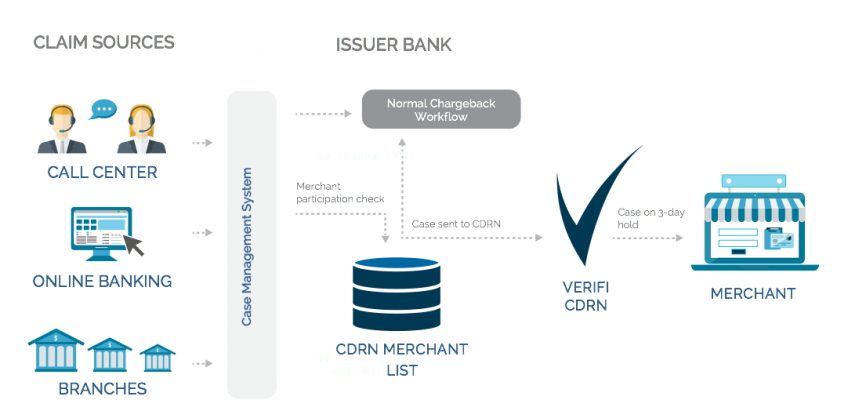

“The key functionality we enable is to connect all the parties to the transaction with the right information at the right time,” says Katz. “Our Order Insight platform provides robust transaction data on each sale, like the merchant’s name and contact information, date of purchase, device name used in the order process and many more important details, directly to the consumer via their bank’s mobile or online interfaces. For those consumers who do call the bank, the same information is provided to the bank’s call centre personnel to appropriately legitimise the sale and address the consumer’s questions or concerns. In most cases, having access to this data can resolve a questionable charge and avoid a phone call to the issuer altogether, which saves the merchant money while keeping customers happy.”

Partnering with third-party providers like Verifi makes sound business sense, according to Javelin Research, whose report recommendations lay out the advantages of outsourcing fraud solutions in order to allow merchants to focus on their core business: “The amount they have to put into building, managing, and maintaining in-house solutions has significant negative impact on their ability to scale their business over time.” They also warn that businesses need to be mindful of maintaining and building customer relationships while elevating security checkpoints to combat CNP fraud. “The projected growth of CNP fraud will introduce a new level of burden for digital merchants, which they will be unable to combat from a resource and scalability perspective. This will increase the pressure and negative impacts on them because they will be hit by fraud that they can’t handle. Their inability to scale quickly enough may result in measures that will hinder customer experience. It is imperative that merchants stay customer-friendly in the face of growing fraud pressure.”

It makes sense for merchants to outsource their fraud solutions Share on X

Verifi is investing heavily into its UK market expansion, as well as many other global markets. Since opening their London office just under a year ago, the California-based company says the demand has far exceeded expectations, and they are now focusing on extending their UK network coverage for their Cardholder Dispute Resolution Network (CDRN) to 70% by the end of 2017.

“We currently support hundreds of merchants and recognised global brands in diverse industries spanning digital music, information technology and entertainment, as well as top High Street and UK e-commerce clients,” says Katz, who adds that there is still enormous scope for expansion as the online retail market continues to grow and fraud prevention needs evolve. “Our challenge and goal is to make sure that our data platforms and solutions keep pace with evolving demands, without compromising the customer experience,” he concludes.

Alice Bonasio is a VR and Digital Transformation Consultant and Tech Trends’ Editor in Chief. She also regularly writes for Fast Company, Ars Technica, Quartz, Wired and others. Connect with her on LinkedIn and follow @alicebonasio on Twitter.